Phenomenal Job. Extraordinary Income. Incredibly Fast.

Enroll in ABFI Ventures' Accelerated Automotive Finance Manager Entrance program to acquire the education for this career in less than 30 days.

Join the thousands of people in the United States & Canada currently working in this extremely lucrative career.

The Average Income of F&I Managers is Over $150,000/yr

Automotive Finance Managers (also known as F&I Managers) are paid incredibly well in the United States and Canada. This is extremely rare for a career that can be obtained quickly, doesn't require a college degree and pays so well from starting.

What Is An Automotive Finance Manager/F&I Manager?

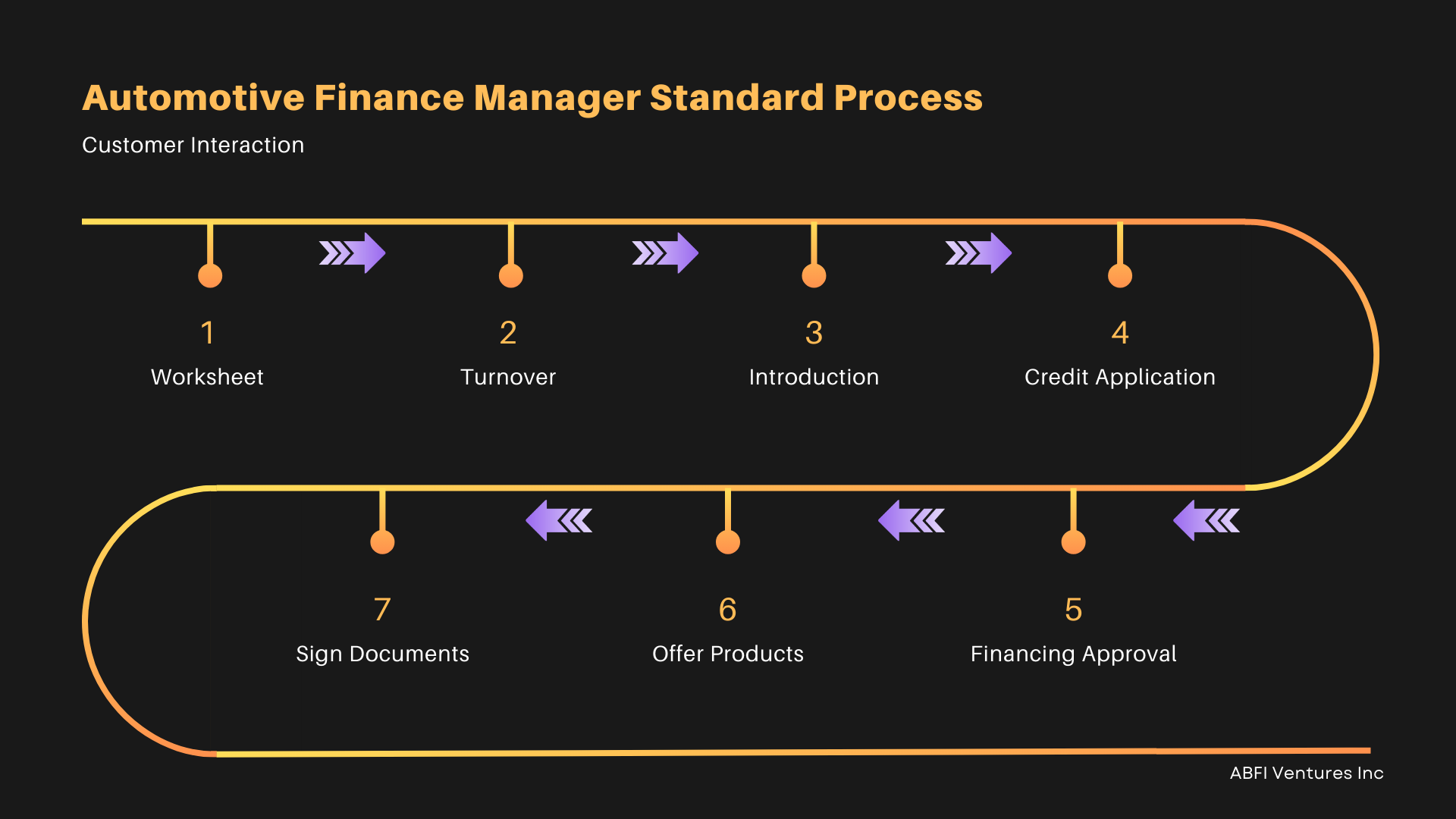

An Automotive Finance Manager (also known as an F&I Manager) is very similar to a Loans Officer at a bank, except that they work for an automotive retailer instead. When a customer at an automotive retailer has decided to purchase a vehicle from one of the salespeople, they are brought to the Automotive Finance Manager to complete the transaction. The Automotive Finance Manager will arrange the customer's financing, discuss available products and complete the paperwork. This process is what makes the Automotive Finance Manager career so appealing. The skills required to perform the basic duties of this position are simple to learn and quite minimal, as the same few skills are used repeatedly with customers. This makes the required knowledge for this career much lower than other careers with comparable compensation.

Why Automotive Finance Managers Are Paid So Well

Even though the work done in this position is relatively simple, it is also incredibly valuable to employers. The average Automotive Finance Manager generates roughly $1,000,000 of revenue per year for their employer. This is all generated by a single person, in one office, using one computer and with very few expenses to the business. This revenue is generated through administration fees, dealer reserve (a fee paid by the banks each time a loan is set up with them) and through the sale of products offered by the Finance Managers. With such a large amount of revenue generated by a single person, automotive retailers happily pay such a high income and they must do so to stay competitive with other employers.

Breakdown Of Automotive Finance Manager Incomes

Throughout the years, there have been numerous polls conducted to identify the incomes of Automotive Finance Managers in North America. The largest and most reputable source being NADA, which is the National Automobile Dealers Association. NADA polls automotive retailers each year on a variety of topics, with one being the annual compensation of Automotive Finance Managers. The last year that NADA publicly released the results of this polling was 2016, in which the average income of Automotive Finance Managers was $132,786/year. More recent polling from independent sources has shown that this income has increased at a rate of roughly 2% per year and currently states that the average income is roughly $151,000 to $157,000/year, with 85% of Automotive Finance Managers earning at least $100,000/year, and 15% earning a staggering $250,000+/year. This shows that even the lowest paid Automotive Finance Managers are still earning an excellent income.

Why Become An Automotive Finance Manager?

The Automotive Finance Manager is one of the most highly desired careers in the world. Expand the blocks below to learn what makes this career so appealing beyond simply its high earnings.

Show Me Enrollment OptionsMinimal Educational Requirements

High Income From Starting

High Advancement Opportunities

Stable & Consistent Income

Hours Of Daily Free Time

Company Vehicle

How To Become An Automotive Finance Manager

There are 3 main paths that people typically take to become an Automotive Finance Manager. Many other paths have been taken to enter this career, however, their effectiveness is limited. The main 3 paths are what the vast majority of Automotive Finance Managers have used to enter this career. Although you do not need a college degree to become an Automotive Finance Manager, you do need to first obtain key skills that are directly or indirectly related to the position. These skills can be acquired by either first working in several types of jobs or completing specific education, each with their own timeframe, advantages and disadvantages. Below is an explanation of each of the 3 main paths.

Working As An Automotive Salesman

Many Automotive Finance Managers first started in this industry as a salesperson and moved into a Finance Manager position a few years later when there was an opening at their store. Salespeople have the advantage of learning how the operations work within an automotive retailer, they gain knowledge of some of the products offered by Finance Managers and they tend to build a relationship with the management team that would be responsible for hiring in finance. In order for them to move into a Finance Manager position when one has opened up, they must typically have a track record of 2+ years as a salesperson, with excellent results. The disadvantages of this path are that it can take a long time for a finance position to become available, their income as a salesperson can fluctuate heavily and management often want them to stay in their current position if they are performing well.

Working As a Loans Officer At A Bank

The skills acquired by working as a Loans Officer at a bank transfer directly to the Automotive Finance Manager role. Both positions deal with arranging financing for clients and offering various products to them. The main advantage of this path is that a person can transition into an Automotive Finance Manager position with a general understanding of how the duties work. Before the pandemic, this was the most effective path that someone could take to become an Automotive Finance Manager. In the post pandemic world, however, revenue generated by Automotive Finance Managers has become much more important and hiring managers now look for applicants that are not only able to perform the basics duties, but also perform well in offering F&I products effectively. This is still a viable path that can be taken but Loans Officers today tend to have difficulty standing out as the applicant to hire, unless they are an extremely high performer in their current role.

Completing An F&I Manager Program

For those that wish to enter this career as quickly as they can, completing an Automotive Finance Manager program is the best choice. These are job training programs that provide students with specific education for the Automotive Finance Manager role, such as the Accelerated program we provide here at ABFI. The main advantages of this path are that it provides the simplest and quickest means of acquiring this career. These programs are short to complete and graduates are desirable to hire, as they possess the specific skills and knowledge required for this career. Programs generally range from 30 days online to 6 months in classroom depending on which option a student wishes to choose. The main disadvantages of this path are that these programs do have a cost of tuition, they require some effort to complete and some programs on the market only teach basic skills that do not make students desirable to employers, as they are limited to teaching the abilities possessed by their trainers.

Show Me Enrollment OptionsWho We Are At ABFI Ventures

A Collective Of Exceptional Performance

Whether it be our executive team, our instructors or our partnering Automotive Finance Managers testing concepts in the field, everyone at ABFI has one critical thing in common. Exceptional Performance in the Automotive Finance Manager role. Our instructors, however, meet an even higher standard. Only true top of industry Automotive Finance Managers instruct our students. This allows us to provide our students with the most effective techniques, methods and skills that impress hiring managers, get students hired quickly and help them perform far above average on the job.

Accelerated Automotive Finance Manager Entrance Program

If you are looking to become an Automotive Finance Manager, ABFI's Accelerated Automotive Finance Manager Entrance program is designed to help you get there as quickly as possible and when you have the time to do so. Our Accelerated program takes, on average, just 30 days of part time study to complete.

Lessons 100% online & on-demand

Lessons accessible 24/7 to learn when convenient for students

Live one-on-one program orientation with an instructor

Live instructor reviews at key milestones (recommended but not mandatory)

Job placement assistance (see FAQ for more information)

Resume assistance, interview preparation & execution

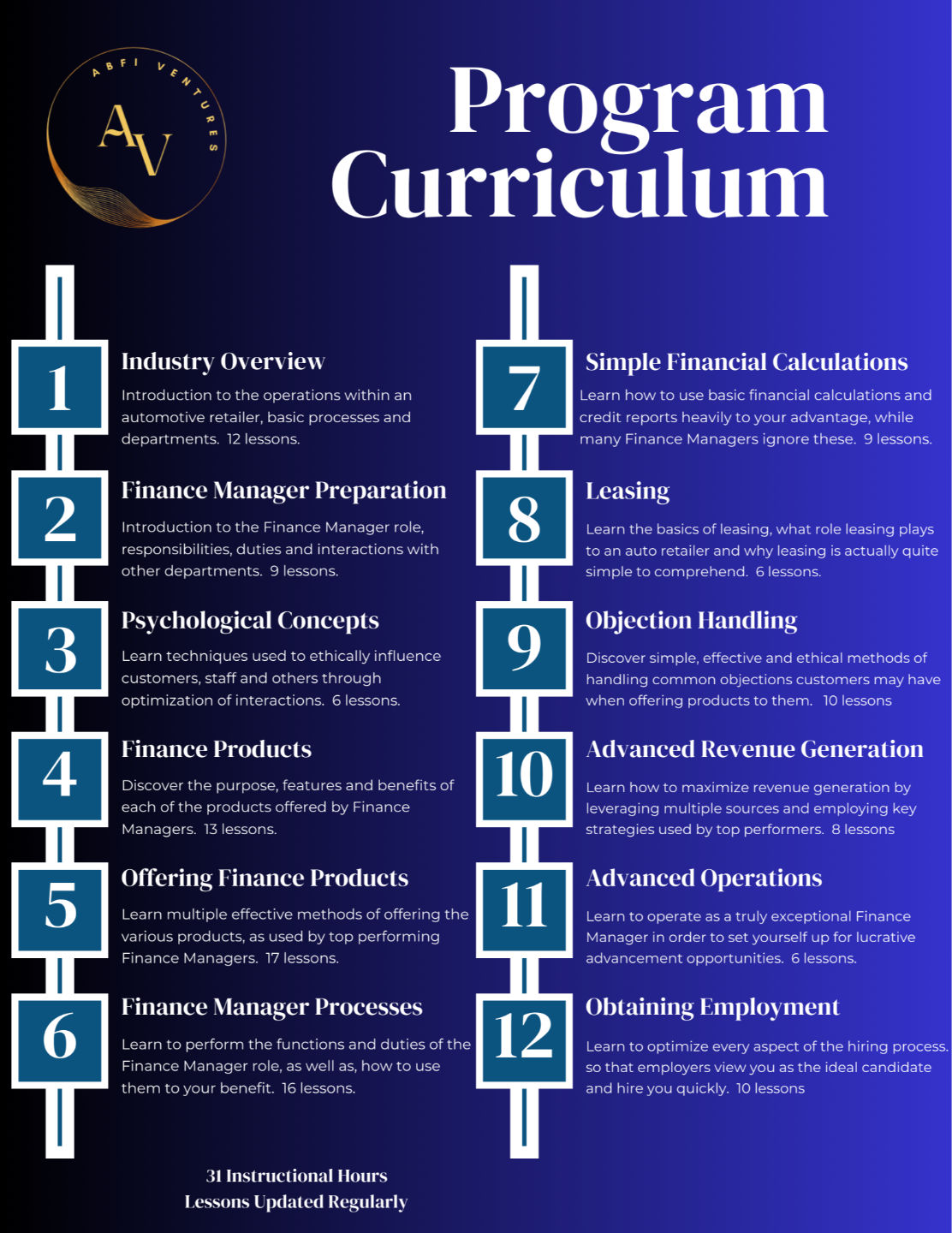

31 instructional hours (subject to change as new optimizations are incorporated)

Access for 1 full year to master concepts on the job

Multiple choice final exam requiring a 70% passing grade

Certificate upon graduation

Available to residents of USA & Canada

Show Me Enrollment Options

Designed To Impress Employers

ABFI's Accelerated Automotive Finance Manager Entrance Program is the result of over a decade of continuous collaboration between industry leading Finance Managers. While most programs teach students basic ways to operate in the role, along with average performing methods of generating revenue, ABFI teaches students how to function at the level of top performers and how to astound interviewers with this knowledge. An example of this is how ABFI teaches students to apply key psychological concepts, such as personality profiling, throughout the entire customer interaction. Graduates of ABFI's program are able to enter job interviews armed with these in depth and impressive approaches, backed by the successes of top performers to set them far apart from other applicants.

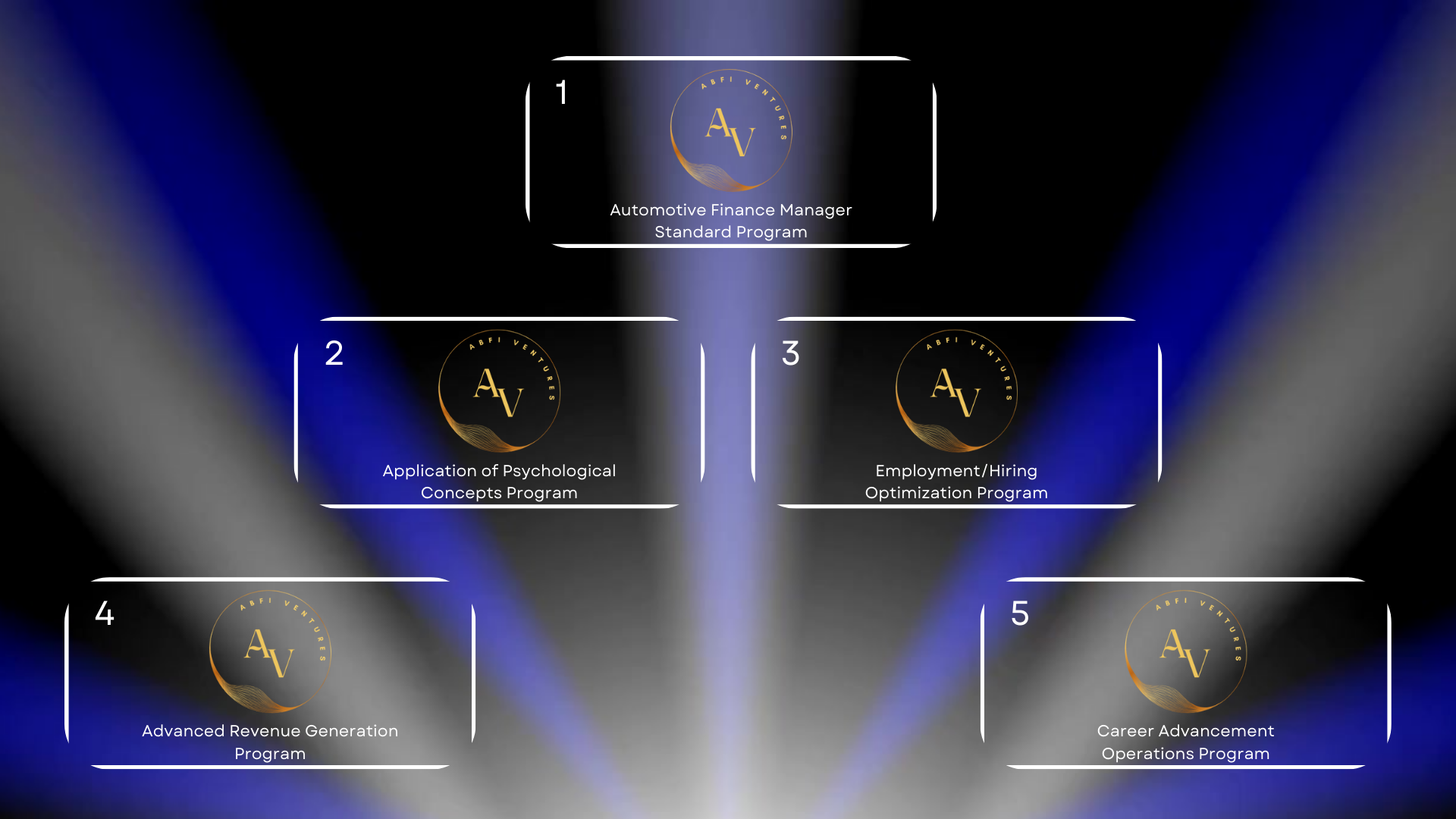

Everything Combined Into One Superior Program

Until recently, ABFI has offered 5 separate programs. Our standard entrance program which provides the base level education to enter this career and 4 advanced, specialty programs designed for existing Automotive Finance Managers to optimize their performance and advance their careers. Our Accelerated program has been created by amalgamating the most effective and impressive concepts of our advanced programs into our standard entrance program. Since the pandemic hit the automotive industry hard, employers now want applicants that have been trained with the most sophisticated approaches, so that's what we now teach to all students in our Accelerated program. All lessons have been redesigned and cross optimized with advanced concepts to provide students with access to all of ABFI's most effective techniques, without increasing program completion time. This allows students to go into interviews armed with the ability to highly impress hiring managers and maximize their income on the job.

Advanced Concepts

Below is an explanation of ABFI's 4 advanced programs that have been incorporated into our Accelerated Automotive Finance Manager Entrance Program. The goal of including these is to provide our students with the most effective and impressive techniques available today to ensure they are not only able to perform extremely well in this career, but also able to get hired into a position quickly after graduating from the program.

Employment/Hiring Optimization

Originally designed to assist existing Automotive Finance Managers in transitioning to more lucrative F&I positions, this program teaches students how to optimize every aspect of the hiring process to ensure they are viewed as the most qualified and ideal candidate to hire. Students are taught how to incorporate the most impressive concepts they've learned and how to leverage ABFI's top performing status, successes and awards to impress hiring managers. Lessons include full resume optimization, applying for positions, interview preparation, employer research and interview execution. The goal of this program is to set students far ahead of other applicants with their resume so they are the front runner that gets interviewed first, demonstrate the potential that only they possess during their interview and get hired on the spot before other applicants have been given an opportunity.

Advanced Revenue Generation

Most Automotive Finance Managers do a poor job of generating revenue. They don't put much effort into offering products to customers, they don't use optimal techniques and they don't implement sophisticated strategies. They do this because their income will be high whether they put in the extra effort or not. This is a large problem in the automotive industry and one that management teams are very aware exists. Fortunately, this creates an opportunity for our students. We teach them the most advanced methods of generating revenue and how to incorporate this knowledge into their interviews, essentially providing hiring managers with exactly what they want the most. When students get hired into a position, they are able to use these methods to perform at a very high level from the most they start.

Career Advancement Operations

As excellent as the Automotive Finance Manager position is, it is just the beginning of this career path. Annual compensation climbs to extremely high amounts by advancing into higher positions. Although this is something that will be some time in the future for our students, key to doing so is implementing strategies from day one on the job so that when this time does come, they are seen as the obvious choice to promote. The strategies taught in this program are simple to implement, yet highly effecting in demonstrating one's value as a leader to their employer. Furthermore, these strategies are among the most valuable for students to discuss in their interviews. These strategies have the ability to positively impact the performance of multiple staff, compounding the value in hiring our students.

Application Of Psychological Concepts

The concepts taught in this program are among the most effective, sophisticated, valuable and impressive concepts that we teach. Beyond introductory concepts, these are the first that we teach to our students and we do this because they are applied in just about every aspect of this position and our main entrance program. Two concepts in particular, Personality Profiling & the Principles of Influence, have exceptional value to our students. These can be applied to virtually any human interaction that we have. With customers when offering products, in interviews when impressing hiring managers, with salespeople to persuade them to sell some of our products ahead of time. Even in our personal lives with friends, family, crushes etc.

Questions About The Program?

Email us at [email protected] and one of our instructors can happily answer your questions.

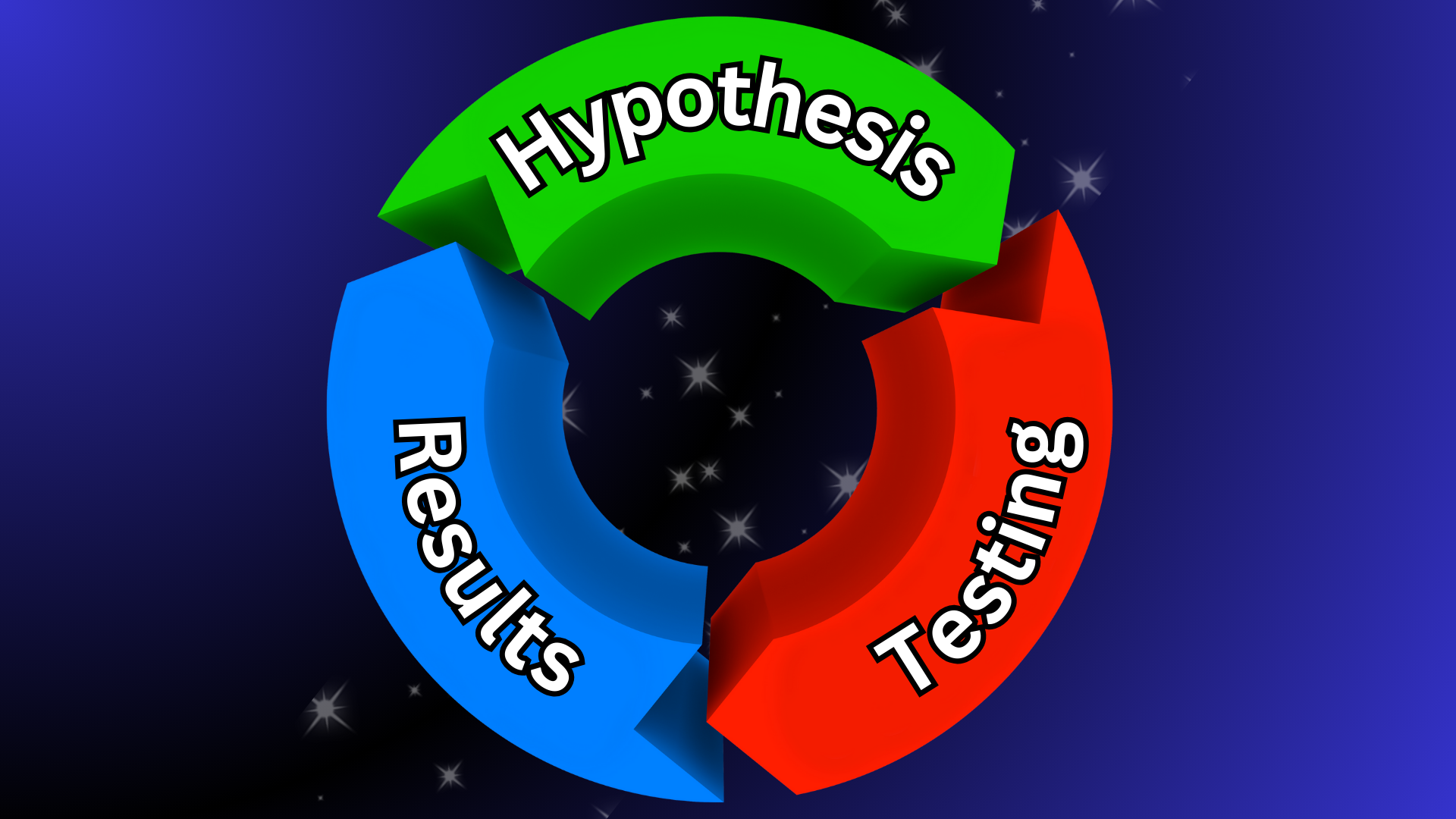

How We Build Our Programs

This industry has many high performers, each possessing a unique variety of skills and techniques for maximizing revenue and earning a far above average income in the Automotive Finance Manager role. This was something that ABFI's founders recognized over a decade ago when they began to build a network of top ethically performing Automotive Finance Managers in the industry. Today, this network is used to continuously evolve ABFI's programs in order to offer our students an unparalleled education. With every program we offer at ABFI, we apply an ongoing process to stay on top of industry best practices and leading techniques. Every method of maximizing revenue and optimizing performance that we teach is continuously filtered through the scientific method. Hypotheses of improvements are sent out to our partner Automotive Finance Managers in the field. They test these hypotheses to identify their effectiveness and report back the results, along with any further discovered optimizations. The results are then analyzed by ABFI's executive team to determine if they are to be incorporated into our programs. New hypotheses are then formulated and the process repeats indefinitely. This process takes significant time and resources, but doing so allows ABFI to provide students with the most effective and sophisticated programs available today.

Guidance From Start To Finish

Here at ABFI, guidance into this career goes well beyond completion of the program. That's only the first couple of steps. Our job is to ensure students are able to get into this career as quickly as possible and capable of performing well when they do. We teach our students how to optimize every step of this career path from completing the basic education to each step of the hiring process and mastering the program's concepts on the job. This allows students to graduate from the program quickly, prepare the right information in the right way for job interviews and become a high performer on the job.

FREQUENTLY ASKED QUESTIONS

Does this career require a college degree?

How old do you need to be to take this pogram?

What is the full refund policy of the program?

Does this job pay on commission?

How do Finance Managers generate revenue?

Can I make $250,000/yr right away if I do well?

I have banking experience. Why would I need a Finance Manager program?

Why do some job postings say they require a college degree or experience?

How long does it take to get a job?

How does job placement assistance work?

Will This Program Work For Me?

If you're unfamiliar with this industry, you may not know how the educational process works and you may be wondering if getting into this career is as simple as completing this program. We understand this concern and we want you to get answers that you confidently know are the unbiased truth. Quite frankly, that means those answers shouldn't come from us here at ABFI. The best way for you to get these answers is to go speak with an Automotive Finance Manager that is currently working in your own city and ask them for yourself. Feel free to ask them about the average income being $150,000/year, if this job's income is stable and high from the start, if completing a Finance Manager program is what it takes to be qualified for this career or anything at all that we've discussed here. They can certainly tell you and this way, you can verify any of the information you've learned here with someone that has no affiliation with us.

Accelerated Finance Manager Entrance Program Tuition Rates

One Time Payment: $1897 USD (Tax Paid)

Online/On-demand: 1 month average completion time with part time study

All 5 of ABFI's individual programs combined, redesigned and optimized to create our most streamlined and effective program to date. This program has been designed as a direct response to the needs of students & the automotive industry post pandemic. With the additional importance of Finance Manager revenue, ABFI's Accelerated Automotive Finance Manager Entrance program is aimed to provide students with the means to obtain a Finance Manager position quickly by arming them with the skills and knowledge that automotive retailers eagerly desire.

The promotional tuition rates are available for the first 150 students to enroll during the current enrollment period on a first come, first serve basis.

The promotional tuition rates will be removed from this page once capacity is reached. Standard program tuition rates will apply after this time.

Access for 1 full year to work towards mastery of concepts.

Multiple choice final exam requiring a 70% passing grade. Certificate upon completion.

Available to residents of USA & Canada.

7 day full refund cancellation period to explore the program risk free before fully committing.

4 Monthly Payments: $574 USD (Tax Paid)

Online/On-demand: 1 month average completion time with part time study

All 5 of ABFI's individual programs combined, redesigned and optimized to create our most streamlined and effective program to date. This program has been designed as a direct response to the needs of students & the automotive industry post pandemic. With the additional importance of Finance Manager revenue, ABFI's Accelerated Automotive Finance Manager Entrance program is aimed to provide students with the means to obtain a Finance Manager position quickly by arming them with the skills and knowledge that automotive retailers eagerly desire.

The promotional tuition rates are available for the first 150 students to enroll during the current enrollment period on a first come, first serve basis.

The promotional tuition rates will be removed from this page once capacity is reached. Standard program tuition rates will apply after this time.

Access for 1 full year to work towards mastery of concepts.

Multiple choice final exam requiring a 70% passing grade. Certificate upon completion.

Available to residents of USA & Canada.

7 day full refund cancellation period to explore the program risk free before fully committing.

LIMITED AVAILABILITY

We are unfortunately only able to accept a total of 150 students across North America at this time through our Youtuber partner program, as to ensure quality of student care. We have not yet reached capacity, however, once it is met, enrollment options will be disabled. Students wishing to enroll after this time will be placed on a wait list and subject to standard program tuition rates when an open position becomes available.